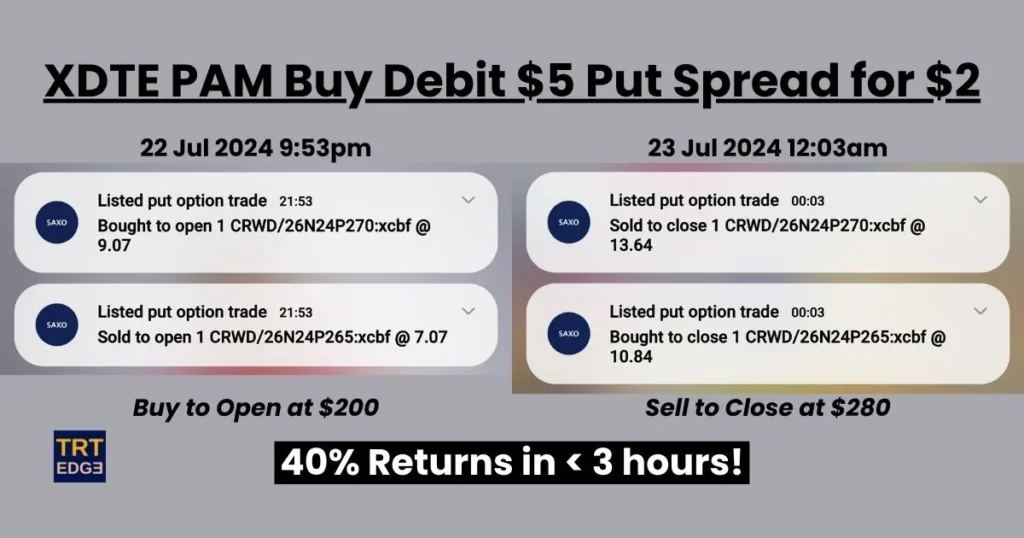

Unusual CrowdStrike Options Chain Spotted on 19 July 2024

On 19 July 2024, market watchers and financial analysts were abuzz with activity surrounding the unusual CrowdStrike options chain spotted for CrowdStrike Holdings, Inc. (CRWD). CrowdStrike, a leader in cybersecurity, has consistently been in the spotlight due to its robust performance and vital role in the increasingly digital world. However, the options activity on this particular day drew significant attention and speculation, as a massive global IT crash triggered by CrowdStrike update hits airlines, banks and media.

What Happened to the CrowdStrike Options Chain?

Options chains are critical tools in understanding market sentiment. They provide insights into the expectations of investors regarding a stock’s future price movements. On 19 July 2024, an unusually high volume of options activity for CrowdStrike was observed, raising eyebrows among traders and analysts alike.

Key Observations

- Spike in Call Options: There was a notable surge in call options, particularly those set to expire in the near term. This suggests that a substantial number of investors were betting on a significant upward movement in CrowdStrike’s stock price.

- Unusual Strike Prices: Many of the call options were centered around strike prices significantly higher than the current trading price of CrowdStrike shares. This indicated a strong bullish sentiment, with traders expecting considerable gains.

- High Open Interest: The open interest for several strike prices was unusually high. Open interest represents the total number of outstanding options contracts that have not been settled. High open interest, combined with increased volume, often points to institutional interest.

Possible Reasons Behind the Activity

Several factors might have contributed to this unusual options activity:

- Earnings Report Anticipation: CrowdStrike was scheduled to release its quarterly earnings report shortly after this date. Traders might have been positioning themselves in anticipation of strong financial results and positive guidance.

- Mergers and Acquisitions Speculation: There were rumors in the market about potential acquisitions or partnerships involving CrowdStrike. Such speculation can lead to heightened activity as investors try to capitalize on potential news-driven price spikes.

- Sector-Wide Movement: The cybersecurity sector as a whole was experiencing increased attention due to rising cyber threats and high-profile breaches. A positive outlook on the sector could have driven interest in key players like CrowdStrike.

Implications for Investors

For retail investors, such unusual activity can be both an opportunity and a risk. It’s crucial to understand the potential reasons behind the movement and not to act purely on speculation. Here are a few tips for navigating these waters:

- Do Your Research: Before making any investment decisions, ensure you have a solid understanding of the company’s fundamentals and the broader market context.

- Watch for Earnings Reports: If the unusual activity is tied to an upcoming earnings report, pay close attention to the actual results and the market’s reaction. Sometimes, the market moves in unexpected ways even if the earnings are strong.

- Consider the Expiration Dates: Options have expiration dates, and the timing of these dates can impact their value significantly. Be mindful of how close you are to these dates when making trades.

- Manage Risk: Options trading can be highly volatile. Use risk management strategies like setting stop-loss orders or limiting the portion of your portfolio allocated to options trades.

Conclusion

The unusual options activity spotted on CrowdStrike on 19 July 2024, highlights the dynamic nature of the stock market and the various factors that can influence investor behavior. Whether it was driven by earnings expectations, acquisition rumors, or broader sector trends, such events offer valuable insights into market sentiment. For investors, staying informed and approaching these opportunities with caution is key to navigating the complexities of options trading.

Investing in the stock market requires continuous learning and vigilance. Keep an eye on market trends, stay updated with company news, and always be prepared to adjust your strategies based on the latest information. Happy trading!

If you would like to know more about our mentorship and classes, or if you would like to express interest in a strategy workshop, contact us.