Options 101: Risk Less, Gain More

SG$188

This intensive Options 101 masterclass offers a comprehensive dive into the world of options trading, tailored for beginners and intermediate traders.

Over three evenings, you’ll gain foundational knowledge, explore advanced strategies, and participate in live market trading sessions, designed to enhance your skills and equip you to succeed in options trading.

86 in stock

Session 1: Options Foundations

Topics Covered:

- Introduction to Options:

- What are Options?

- Comparing Shares, Indexes, and Physical Assets vs. Options.

- Opportunities with Options vs. Shares.

- Definitions, Benefits, and Risks.

- Types of Options: Call and Put.

- Options Terminology:

- Contract Specifications.

- Key Terms: Strike Price, Expiration Date, Underlying Asset.

- In-the-Money, Out-of-the-Money, At-the-Money.

- Cash vs. Physical Options.

- Options Trading Basics:

- Basic Strategies: Buying Calls and Puts.

- Case Studies and Real-Time Market Examples.

- Live Market Interactive Learning:

- Explore Directional Trading with Debit Call and Put Options.

Session 2: Options Pricing, Capital Risk & Risk Management

Topics Covered:

- Options Expiration and Assignment:

- Understanding Expiration, Assignment, and Exercise Processes.

- Options Theoretical Pricing:

- Greeks and Pricing Models.

- Volatility Types: Historical, Statistical, and Implied.

- Market vs. Theoretical Pricing.

- Options Premiums and Volatility:

- Intrinsic Value, Time Value, and Volatility.

- Factors Affecting Options Prices.

- Risk Management and Trade Expectations:

- Risk Management Techniques.

- Handling Emotions, Expectations, and Position Sizing.

- Capital Risk vs. Probabilities and Time.

- Options Trading Strategies:

- Strategies for Different Market Conditions: Bullish, Bearish, Multi-Directional.

- Open Capital vs. Defined Capital Strategies.

- Live Market Interactive Learning:

- Selling Options for Income.

- Buying Leap Investing Options for Long-Term Gains.

Session 3: Portfolio Concepts & Advanced Options Strategies

Topics Covered:

- Portfolio Trade Masterplan:

- Developing a Comprehensive Trading Strategy for Bull, Bear, and Kangaroo Markets.

- Sample Portfolio Plan for a $5k Account.

- Trading Psychology and Discipline:

- Learning to Trade vs. Trading to Learn.

- Managing Emotions, Biases, and Discipline.

- Building a Personalized Trading Plan and Routine.

- Advanced Options Strategies:

- Directional, Income Generating, and Multi-Directional Breakout Strategies.

- Portfolio Hedging Tactics.

- Live Market Interactive Learning:

- Implementing Various Options Strategies Based on Market Conditions.

Popular Strategies Include:

- Long Call & Put.

- Bull Call Spread, Bear Put Spread.

- Protective Put, Covered Call.

- Iron Condor and More!

Note: Only select strategies will be covered during the live sessions based on time availability.

Additional Resources

- Access to an online community for discussion and support.

- Recordings of live sessions for future reference.

Masterclass Objectives

By the end of this masterclass, participants will:

- Gain a solid foundation in options trading basics and terminology.

- Master options trading strategies and risk management techniques.

- Build a trading plan and understand trading psychology.

- Discover multiple trading opportunities using options strategies.

Target Audience

- Beginner options traders.

- Investors looking to diversify their portfolios.

- Traders seeking to expand their trading knowledge and opportunities.

Prerequisites

- Basic understanding of financial markets and instruments.

Date, Time and Venue

Session 1

- Date: 16 Dec 2024

- Time: 8pm to 11pm SGT

- Online webclass

Session 2

- Date: 17 Dec 2024

- Time: 8pm to 11pm SGT

- Online webclass

Session 3

- Date: 18 Dec 2024

- Time: 8pm to 11pm SGT

- Online webclass

Webclass link will be sent to you via email within 15 minutes upon order completion.

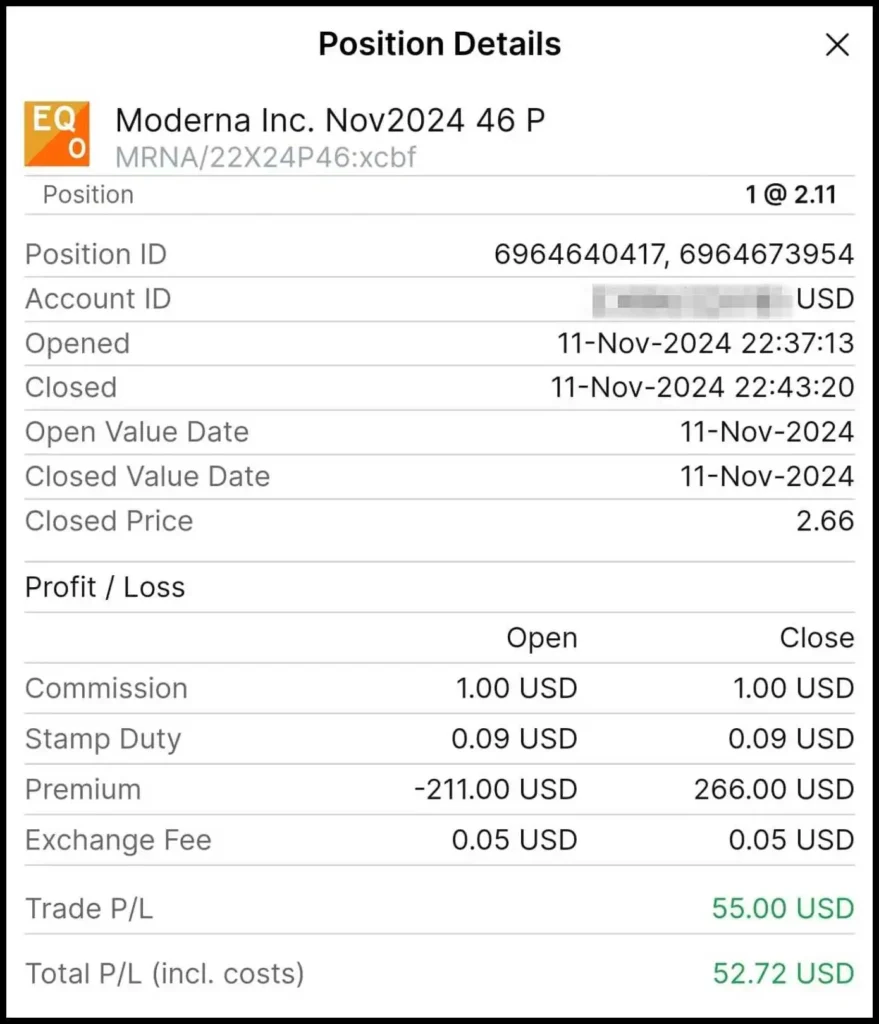

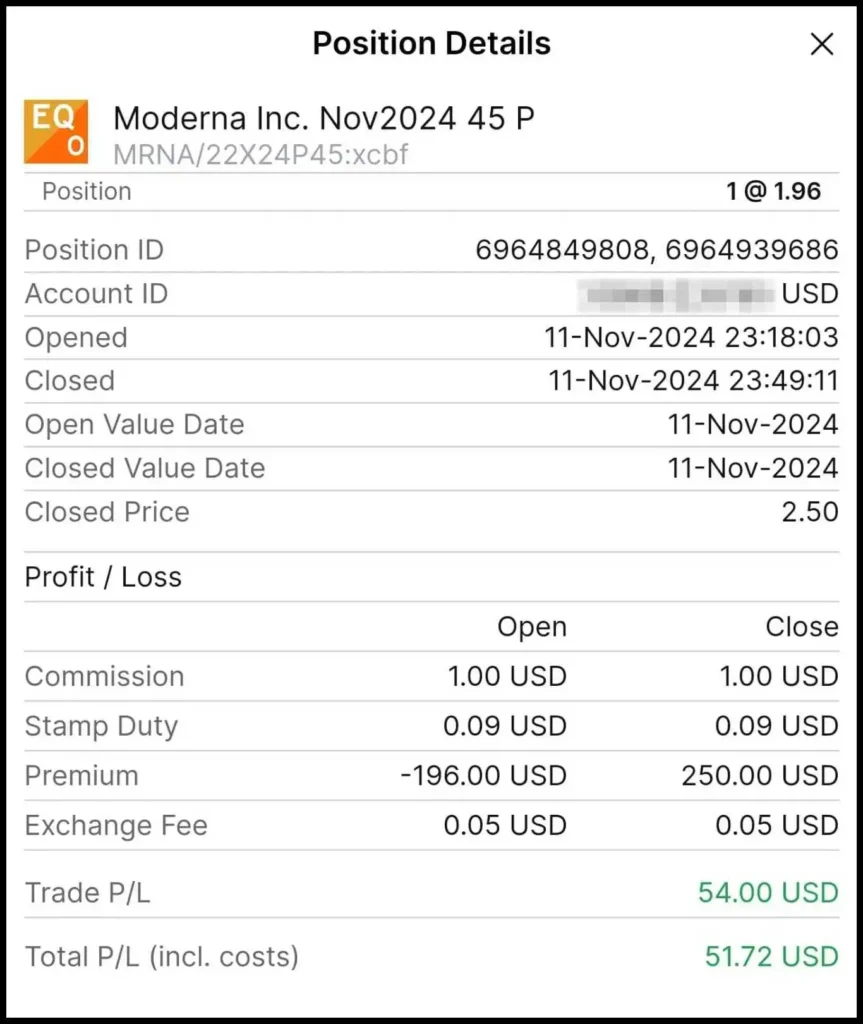

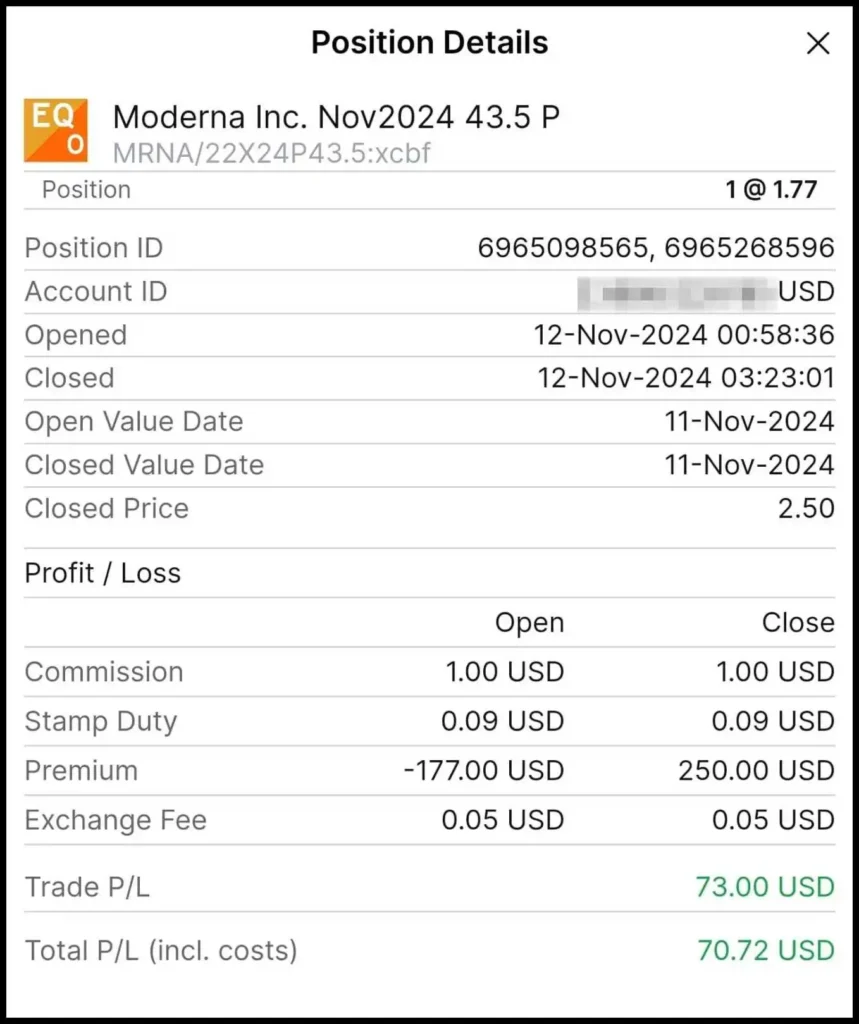

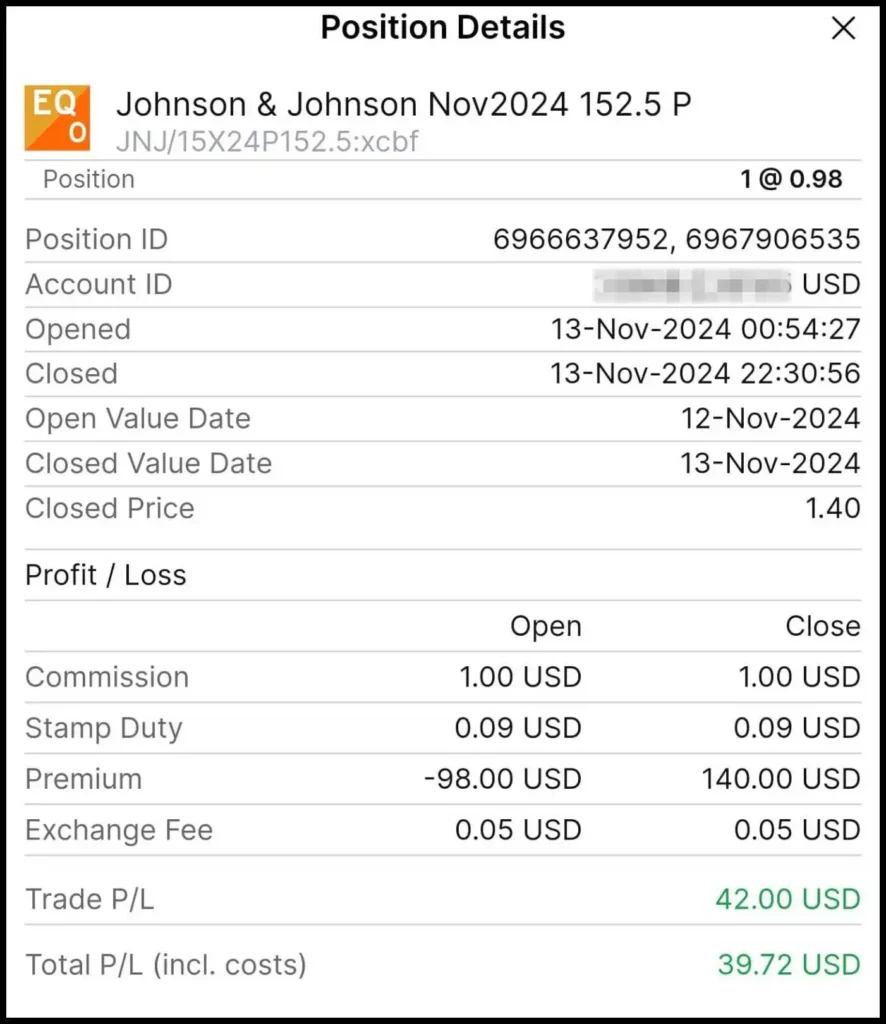

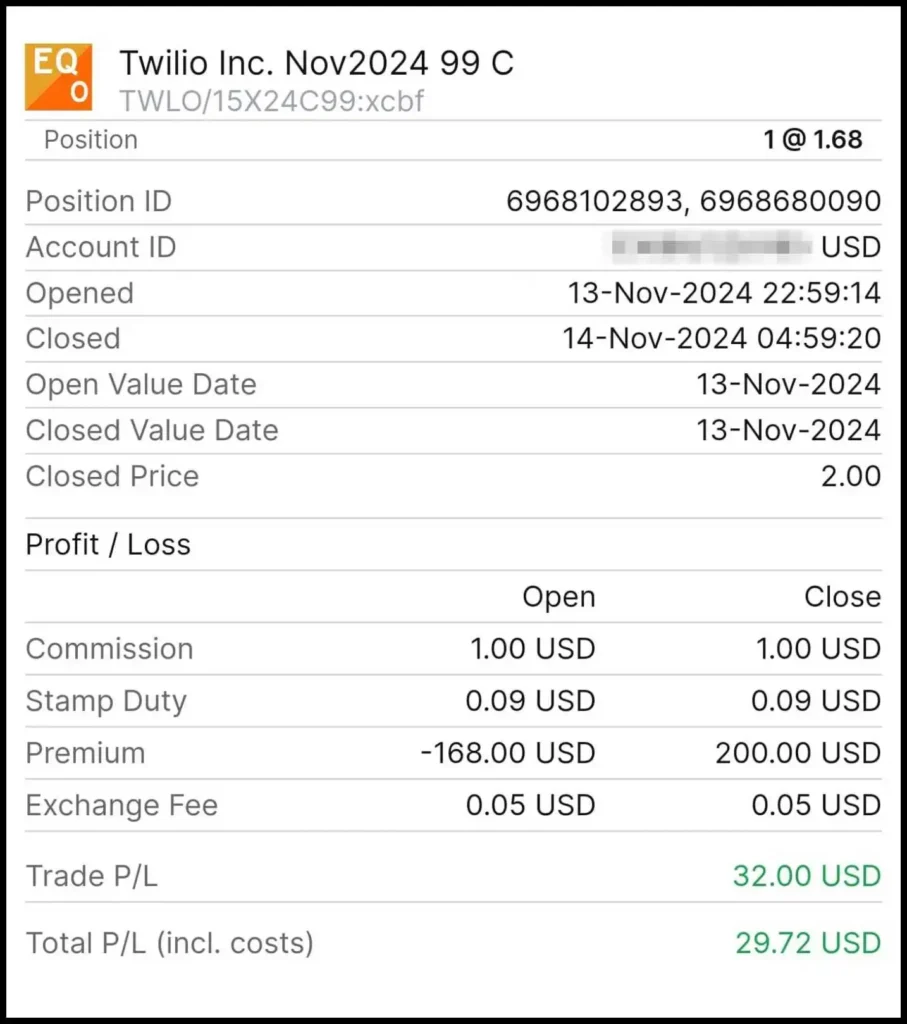

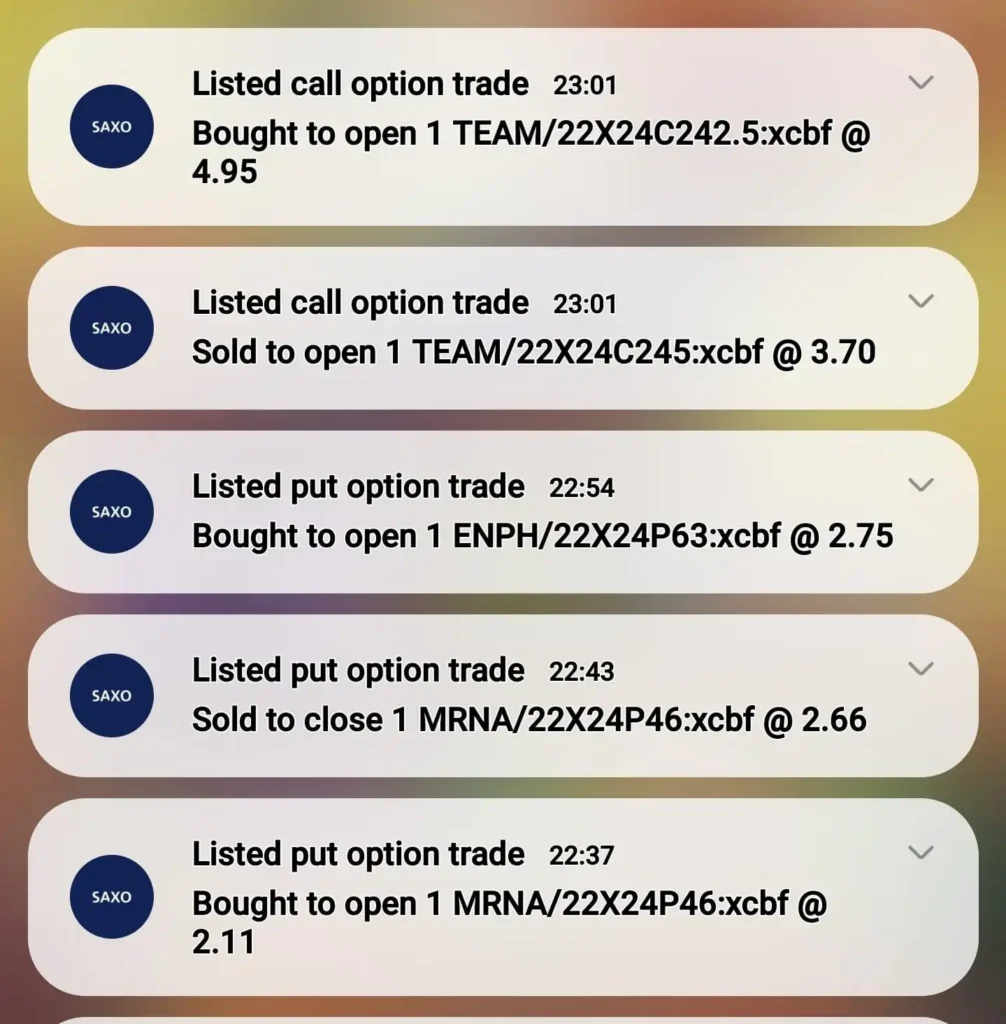

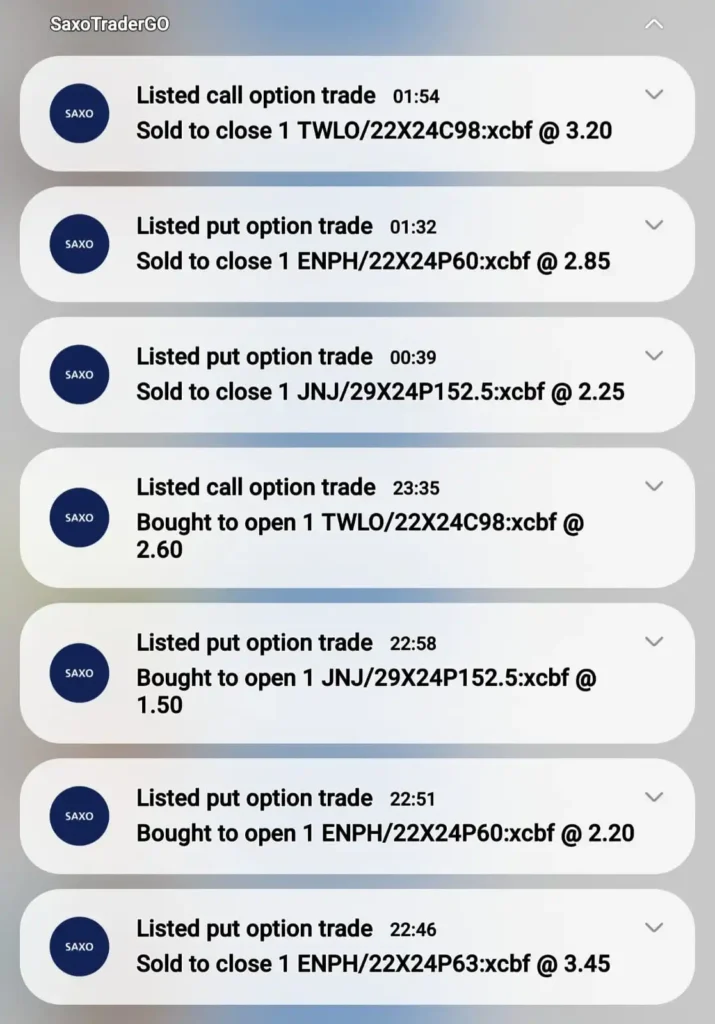

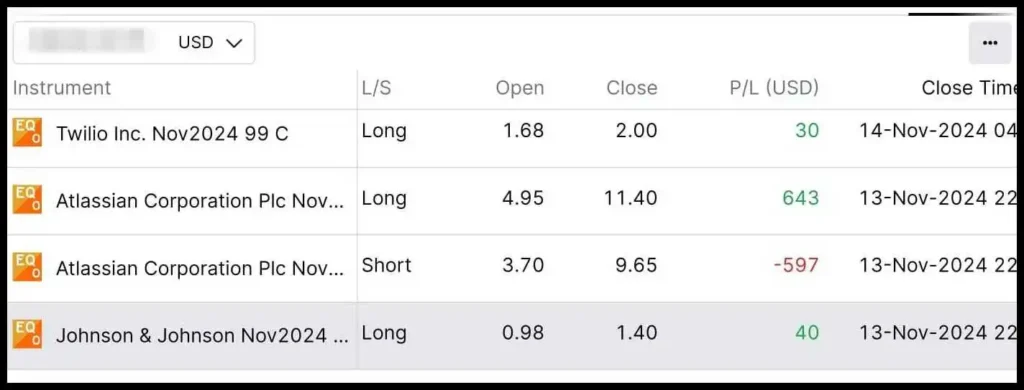

Trades Entered During Past Webclasses