What is GBTC (Grayscale Bitcoin Trust ETF) & How to Trade It

Introduction

Cryptocurrencies have taken the financial world by storm, and Bitcoin stands as a flagship in this digital revolution. For investors who want exposure to Bitcoin without directly holding the cryptocurrency, the Grayscale Bitcoin Trust ETF (GBTC) provides a convenient avenue. In this blog, we’ll delve into what GBTC is, how it works, and the steps involved in trading it.

What is GBTC (Grayscale Bitcoin Trust ETF)?

Grayscale Bitcoin Trust (GBTC) is a financial product created by Grayscale Investments, a digital asset management company. It operates as an investment fund that holds Bitcoin and allows investors to gain exposure to the cryptocurrency’s price movements without directly owning or managing the digital asset. GBTC is structured as a trust rather than a traditional exchange-traded fund (ETF), making it unique in the market.

How Does GBTC Work?

- Bitcoin Custody: Grayscale Investments holds a significant amount of Bitcoin in cold storage, meaning the private keys controlling access to the cryptocurrency are stored offline to enhance security.

- Issuance of Shares: Investors can buy shares in the Grayscale Bitcoin Trust through New York Stock Exchange (NYSE). These shares represent a proportional interest in the underlying Bitcoin held by the trust.

- Market Trading: Once the shares are issued, they can be bought and sold on brokerage trading platforms, similar to stocks. This platform trading is where investors can actively trade GBTC.

Advantages of GBTC

- Convenience: GBTC provides a simple and familiar way for traditional investors to gain exposure to Bitcoin without dealing with the complexities of cryptocurrency ownership.

- Security: Investors don’t need to manage private keys or worry about securing their Bitcoin holdings. Grayscale Investments takes care of the custody and security aspects.

- Regulatory Oversight: As a regulated investment vehicle, GBTC offers a level of regulatory oversight that might appeal to institutional investors or those seeking a more traditional investment approach.

Trading GBTC

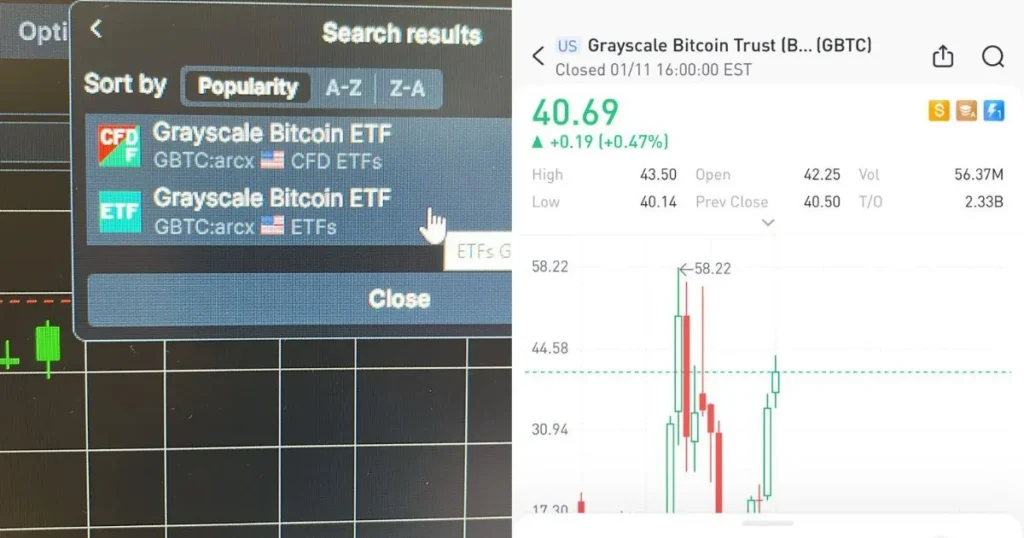

- Opening a Brokerage Account: To trade GBTC, investors need to open a brokerage account such as Saxo Markets and Tiger Brokers that offers access to NYSE. Not all brokers provide access to GBTC, so it’s essential to choose a platform that supports this investment.

- Research and Analysis: Before trading GBTC, conduct thorough research on Bitcoin’s price trends and market conditions. Understanding the cryptocurrency market is crucial for making informed investment decisions.

- Placing Orders: Once the brokerage account is set up, investors can place buy or sell orders for GBTC shares through the trading platform. It’s essential to set appropriate limits and stop-loss orders to manage risk.

- Monitoring Performance: Keep track of the performance of both GBTC and the underlying Bitcoin market. Cryptocurrency markets can be volatile, and staying informed helps investors make timely decisions.

Risks and Considerations

- Premium/Discount: GBTC often trades at a premium or discount to the net asset value (NAV) of its underlying Bitcoin holdings. Understanding this dynamic is crucial for investors to make informed decisions.

- Cryptocurrency Volatility: Bitcoin is known for its price volatility. Investors should be prepared for significant price swings in both GBTC and the cryptocurrency market.

- Market Liquidity: Trading volumes in GBTC may vary, affecting liquidity. Thinly traded securities can lead to wider bid-ask spreads and potentially impact the execution of trades.

Conclusion

Grayscale Bitcoin Trust ETF offers a unique investment opportunity for those seeking exposure to Bitcoin without directly owning the cryptocurrency. However, investors should carefully consider the risks and do their due diligence before trading GBTC. As with any investment, staying informed and being aware of market dynamics are crucial for success in the evolving world of cryptocurrency investments.

If you would like to know more about our mentorship and classes, or if you would like to express interest in a strategy workshop, contact us.